Do you wonder if it makes more sense to buy a home now or wait? That's been the #1 question I receive from both Dallas home buyers and home sellers. Experts will agree that while there may be a lot to consider depending upon what is happening in your market and potential changes to mortgage interest rates but all agree that trying to "time the market" is not a good strategy.

There are just too many variables, so here is how experts better explain your best strategy--time in the market. If you are considering buying a home in Dallas or any Dallas suburb and your financial situation works now, buying sooner rather than later is usually worth it. Bankrate explains why:

“No matter which way the real estate market is leaning, though, buying now means you can start building equity immediately.”

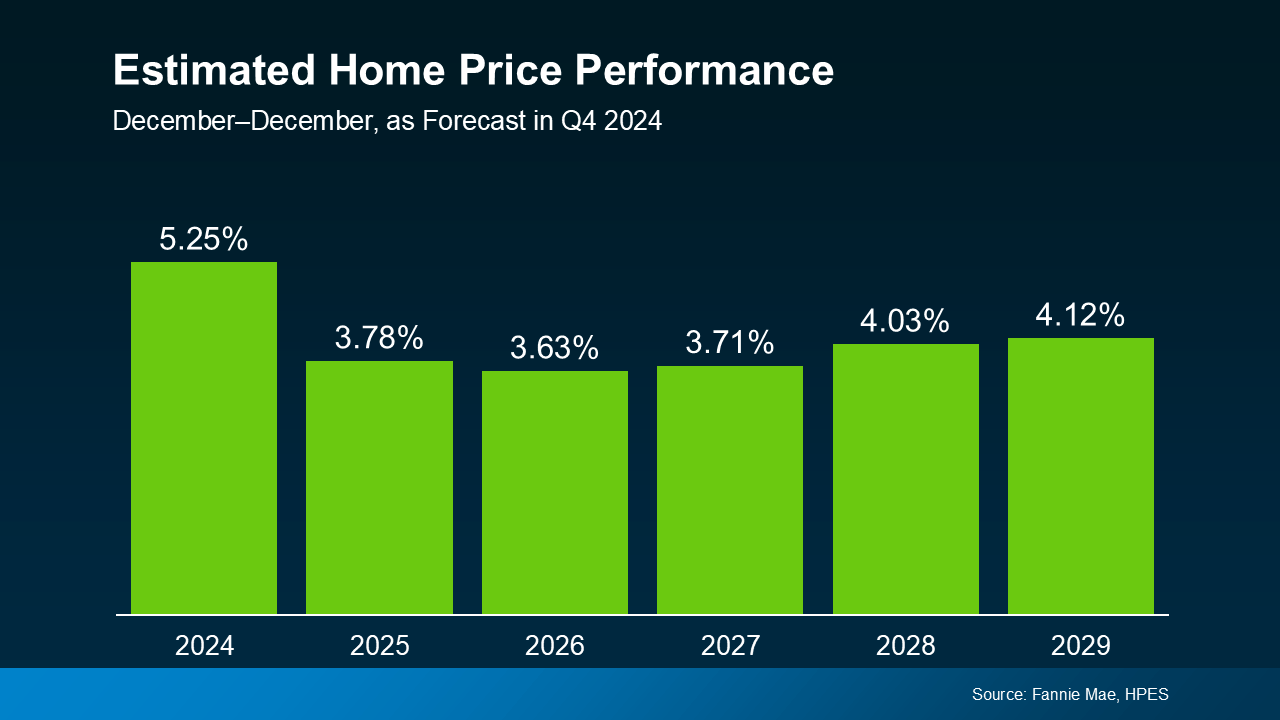

Here’s some data to break this down so you can really see the benefit of buying now versus later – if you’re able to. Each quarter, Fannie Mae releases the Home Price Expectations Survey. It asks over one hundred economists, real estate experts, and investment and market strategists what they forecast for home prices over the next five years. In the latest release, experts are projecting home prices will continue to rise through at least 2029 – just at a slower, more normal pace than they did over the past few years (see the graph below):

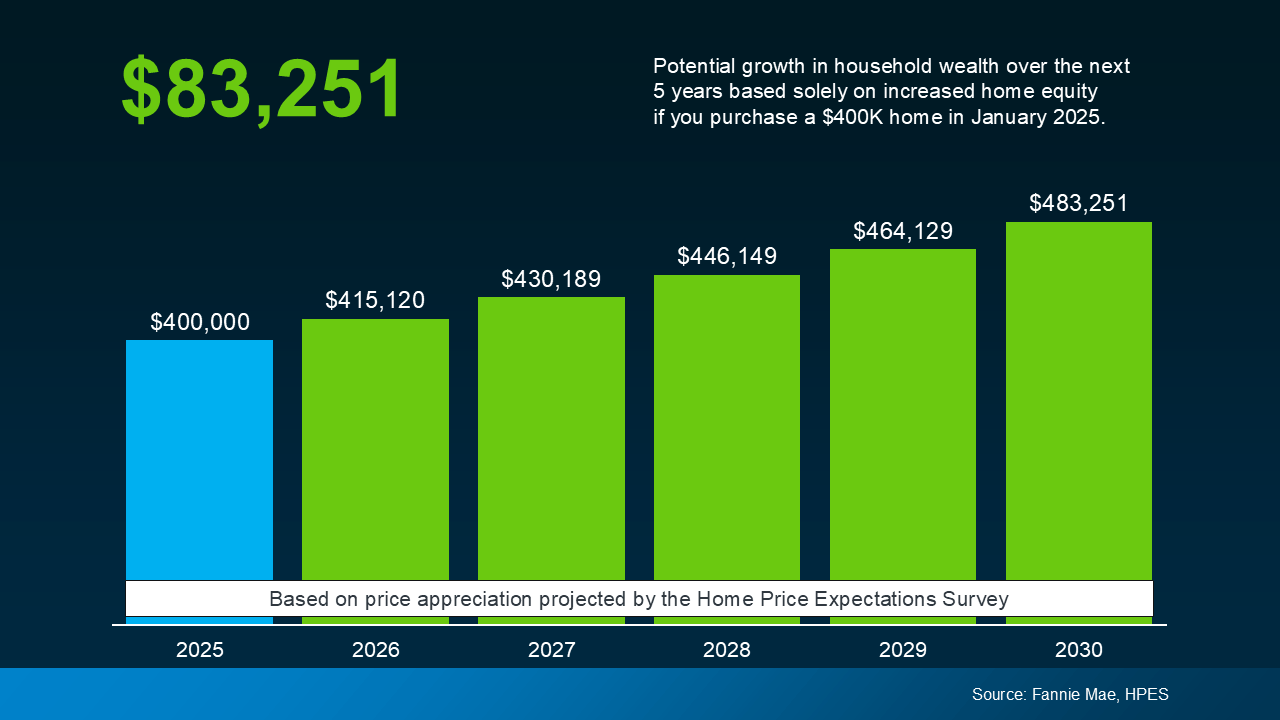

Wondering what this really means for you? To give these numbers context, the graph below uses a typical home value to show how it could appreciate over the next few years using those HPES projections (see graph below). This is what you could start to earn in equity if you buy a home in early 2025.

In this example, let’s say you go ahead and buy a $400,000 home this January. Based on the expert forecasts from the HPES, you could gain more than $83,000 in household wealth over the next five years. That’s not a small number. If you keep on renting, you’re losing out on this equity gain and only contributing to your landlord's equity, not yours!

And while today’s market has its fair share of challenges, this is why buying is going to be worth it in the long run. If you want to buy a home and you don't find yourself in a "perfect" situation, don't give up. There are creative ways we can make your purchase possible. From looking at more affordable areas, to considering condos or townhomes, or even checking out down payment assistance programs, there are options to help you make it happen. I have helped many buyers from first time home buyers to luxury home buyers buy a brand new home and receive an interest rate 1-2 points below today's market rates based on builder incentives.

So sure, you could wait. But if you’re just waiting it out to perfectly time the market, this is what you’re missing out on. And that decision is up to you. Need more information or help to determine when is the best time is for you? Contact me today for an in person or Zoom consultation. It's always complimentary!